Purdue Engineering will celebrate 150 years with its sesquicentennial celebration in 2024-25

Purdue University's College of Engineering sesquicentennial will be a yearlong celebration, starting in September 2024.

April 1, 2024

IE’s Johnson, ECE’s Rogers selected by NAE to attend prestigious national symposium

David Johnson, associate professor of industrial engineering and political science, and Tim Rogers, associate professor of electrical and computer engineering, are two of the highly accomplished early-career engineers selected by the National Academy of Engineering (NAE) to participate in the 2024 Grainger Foundation Frontiers of Engineering Symposium to be held in Irvine, Calif., Sept. 11-14.

June 13, 2024

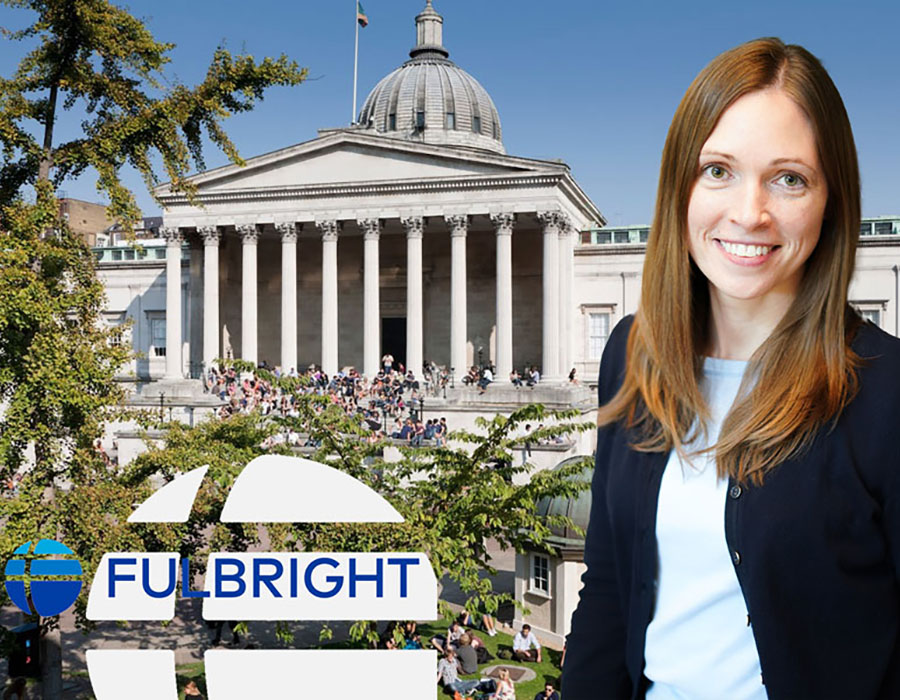

BME's Green receives MIT Technology Review's 2024 Innovators Under 35 honor

September 18, 2024

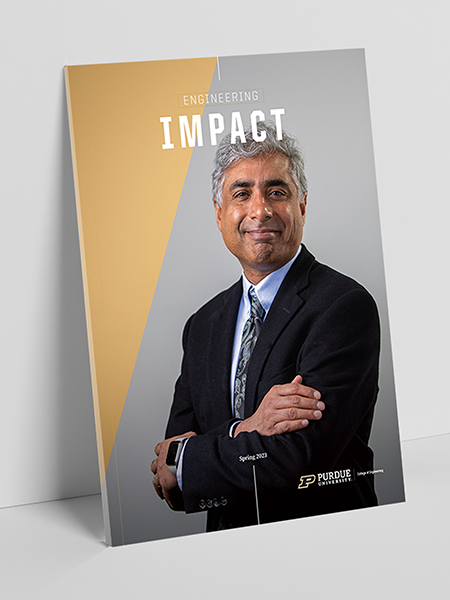

ECE's Bagchi finalist for global engineering award

Saurabh Bagchi, professor in the Elmore School of Electrical and Computer Engineering, is a finalist for the Institution of Engineering Technology (IET) Achievement Medal, a global award in engineering. Winners will be announced and presented in London on Oct. 18.

September 19, 2024