Engineering a Currency Exchange Algorithm, Recent Graduates Persist during COVID-19

“When COVID started, I was joking with my co-founder, 'I’m moving to California to work on the startup full time'. A week later, I bought my ticket and did it.”

Araña started out like many students, working, going to class, and learning about what caught his interest and energy. Ivo started tossing around an idea for a product to optimize currency exchange trading in the FOREX market. He found some like minds and got to work, founding AlgoWealth in October 2018 with another Purdue alumnus, Jeremy Meyer.

“AlgoWealth is a financially engineered portfolio of algorithms, combined with human expertise, that is able to turn the Currency Exchange Market into a source of passive income. The algorithms are licensed as a software-as-a-service and it falls in the category of a boutique social copy trader provider.”

As a Purdue IE student, Ivo was taught that the efficiency of the design was just as important as building the asset in classes such as IE 484. “For many months we were working with a system that didn´t really get us anywhere so we had to call it quits, use the lessons learned and start again. At Purdue they are very keen on building our ambiguity and system valuation skills. If you design something and you know it can be better, then no matter how much effort it takes we are going to push our boundaries and discover what we can find in the unknown.”

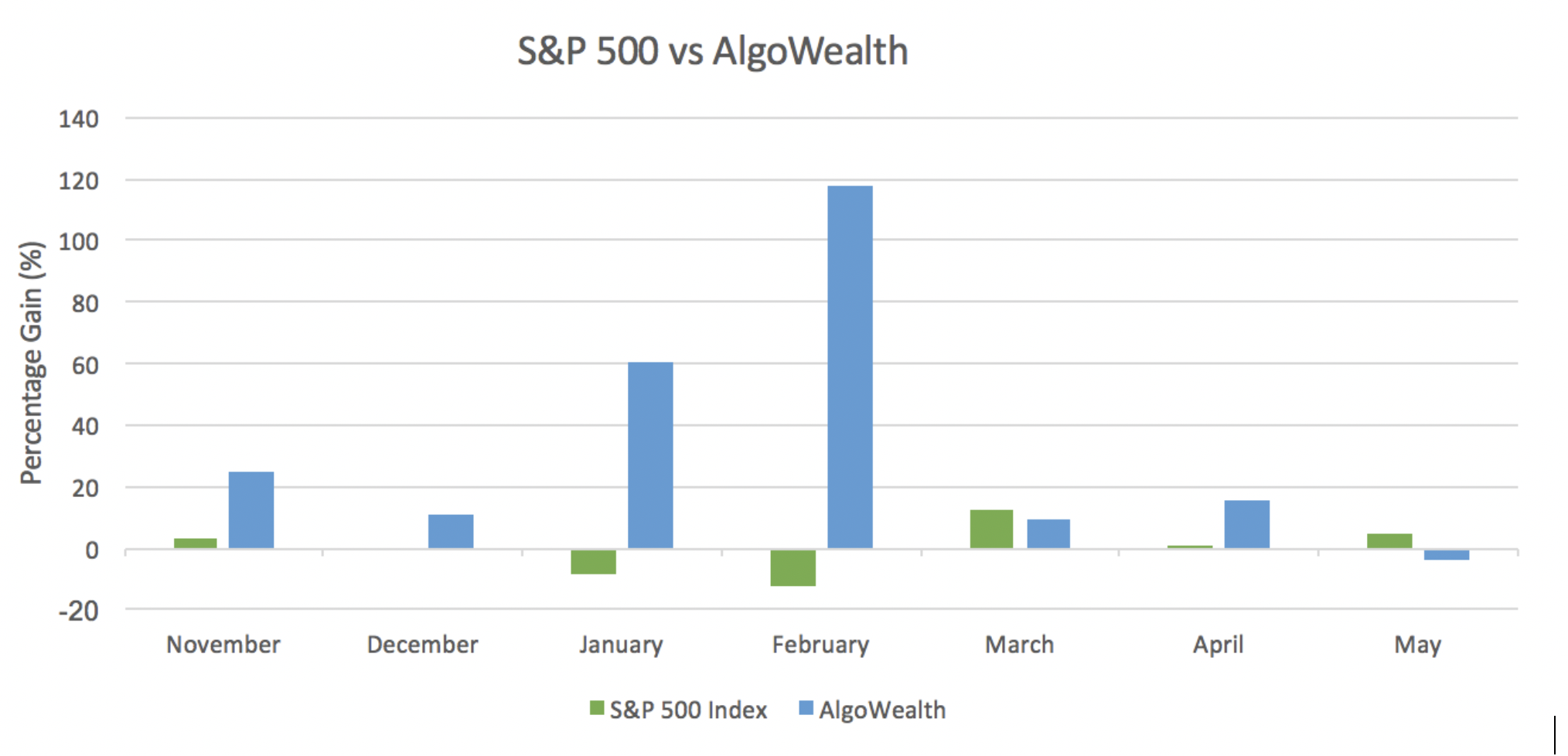

By November 2019, after a year of design and implementation they were ready to launch a portfolio of algorithms. Ivo describes, “Our historical back tests were generating consistent returns on average of 3% up to 10% a month but due to the immense volatility that surged due to the start of the pandemic, our algorithm was able to capitalize. We expected to be profitable, but the numbers we saw were hard to grasp.”

That wasn’t the only thing AlgoWealth did this spring. They rounded the team with another industrial engineering May graduate, Dylan Stants, an experienced currency trader, legal counsel, and programmers. They then hired an external accounting agency to certify results.

Even during COVID-19, Ivo is prepared to expand AlgoWealth during these tumultuous times. When asked what’s next, Ivo replied, “We’ve managed to survive, so I’m grateful for that. We’re still operating and moving forward, learning every day – now we want to expand our company, that’s why we are changing focus to fundraising and building our team. Our vision is to help everyone achieve their financial goals. We are on a mission to make financial freedom accessible.”

Writer: Julia M. Sibley

Source: Ivo Marrero Araña

Related Article: “Living the Financial Engineering Dream”, May 2, 2019