Living the financial engineering dream

IE junior Ivo Marrero

A junior in industrial engineering with a minor in economics, Ivo Marrero is also a trader, algorithm developer, and price action analyst.

"It's a software-as-a-service platform that allows users to capture gains on intraday volatility across multiple financial instruments," Marrero explained. Intraday volatility reflects the up-and-down price fluctuations between the open and close of a trading session.

"Trading is my passion, and I would like to bring the value it creates to people who know little or nothing about it," said Marrero. "Nowadays 70% of market transactions in financial markets take place algorithmically, and there is no available software out there that allow investors to achieve fantastic investing returns via algorithms. That is the space that AlgoBank is filling."

Marrero co-founded AlgoBank in late 2018 with fellow Boilermaker Jeremy Meyer, a 2016 Purdue Computer Science alumnus. Marrero serves as the company's CEO and expert trader, is responsible for creating trading strategies, leads AlgoBank's vision, and maintains a profitable track record (currently at 25% return-on-investment since its inception). As the company grows, he'll also oversee investor relations, lead funding rounds, and build the quantitative analysis (quant) team.

Meyer is the Chief Technology Officer, responsible for building, maintaining, and operating the entire AlgoBank trading platform. In the future, he'll also hire and manage the technical team. Meyer got involved with AlgoBank after meeting Marrero through mutual friends and learning about the opportunities present in the Foreign Exchange Market (FOREX, FX, or currency market) and beyond.

"I've been working on AlgoBank since September 2018," said Marrero. "It brings financial algorithms to retail investors. Each of the 12 algorithms in the AlgoBank platform are continuously scanning the market for trade opportunities that match their setup conditions. Whenever an opportunity arises, they make the trade based on the ideal allotment from a risk/reward perspective. At a higher level, each of the 12 algorithms is scaled up or down based on their recent performance and known market conditions to maximize total profit and risk/reward ratio."

Marrero attributes being an IE as key to his startup's concept, because several IE courses introduced him to programming and optimization. "Our trading strategies are being optimized using techniques from IE courses such as IE 33500 (Operations Research - Optimization) and IE 33600 (Operations Research - Stochastic Models)," he explained.

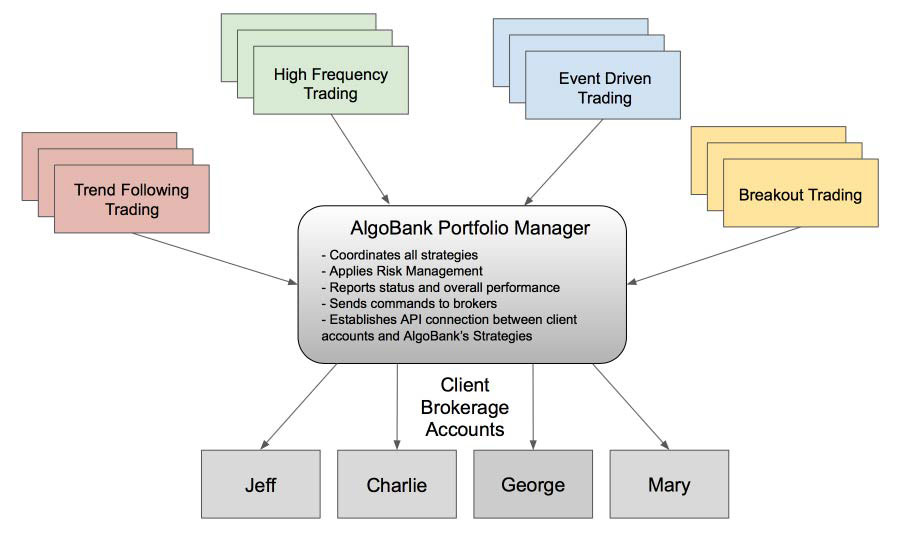

How AlgoBank works: 12 Algorithmic trading strategies are connected to the AlgoBank Portfolio Manager, which automatically coordinates all strategies and executes trades on behalf of AlgoBank users.

"We bank the intraday volatility every day, among the 28 major and minor currency pairs," he said. "For instance, if the Euro to US Dollar currency pair moves 1% up or down, that represents the daily movement for that market. During the day, it could swing 2% in both directions before the market closes. Using a variety of algorithmic methods, AlgoBank takes profit from the movement of the market in any direction. As the markets move around, we would see our AlgoBank equity grow in size. While our test market is FOREX, we do have plans to move into all asset classes because the underlying logic is transferable. We'd like to offer different variations of our services as part of a subscription plan, with the ultimate goal being to make it affordable and accessible for all tiers of investors."

Marrero, from the Canary Islands, plans to focus fully on AlgoBank this summer and wants eventually to move the business to the Silicon Valley. He plans to graduate in May 2020 and keep growing the startup.

"I plan on working on AlgoBank until every single household has the app in their computers, helping them achieve financial success," he said.

Marrero's enthusiasm for the project is boundless. "We are completely changing the game," he promised. "When you find a passion for something and have priorities as clear as I have mine, you find yourself living your dream," he said.

Writer: DeEtte Starr, starrd@purdue.edu

Source: Ivo Marrero, imarrero@purdue.edu