Semiconductors / Programs

DOD Provides Nearly $11M to Expand Microelectronics Workforce Development Program

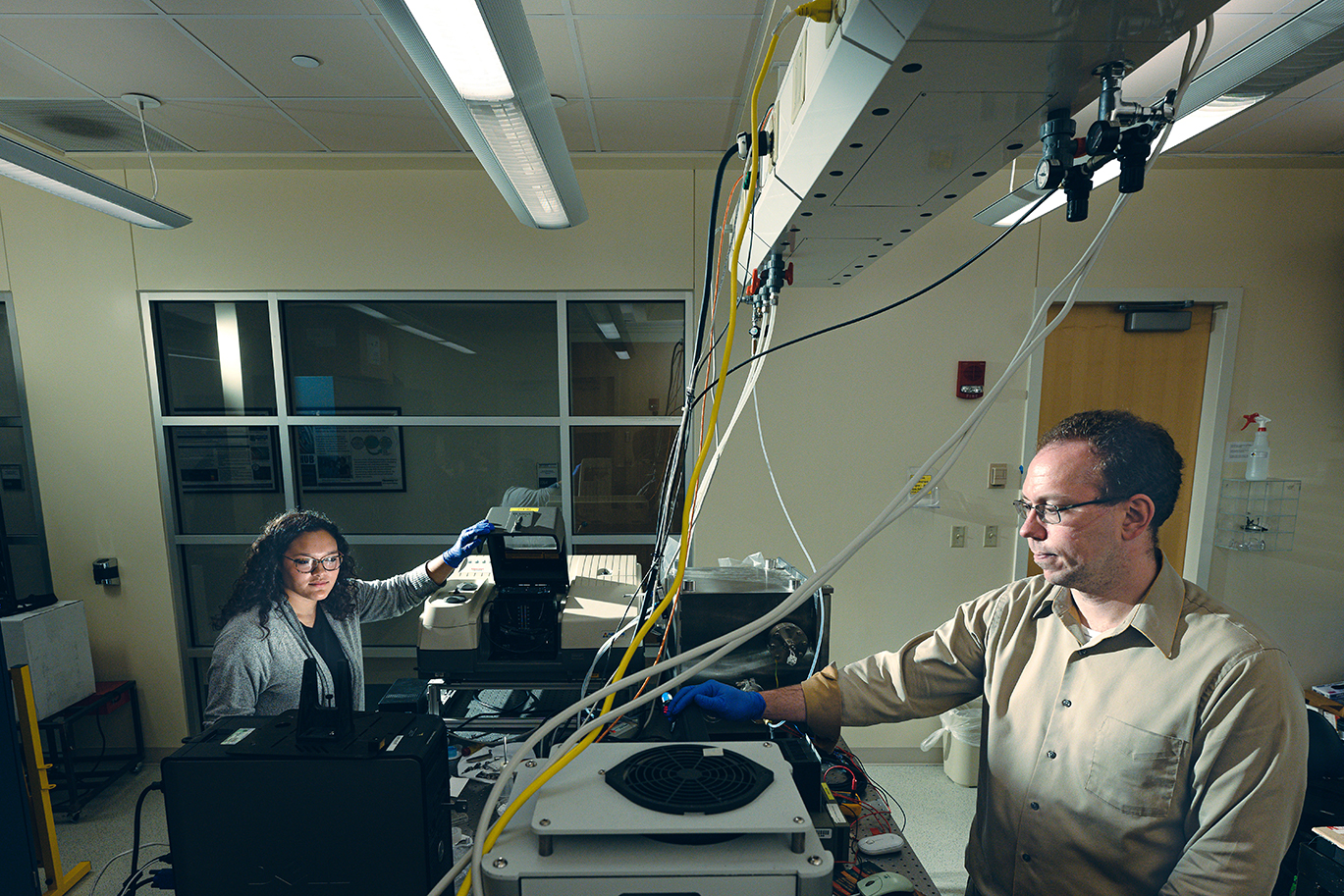

Peter Bermel, the Elmore Associate Professor of Electrical and Computer Engineering, conducts research with a student in Birck Nanotechnology Center. Bermel directs Purdue's Scalable Asymmetric Lifecycle Engagement (SCALE), the preeminent U.S. program for semiconductor workforce development, which received funding to continue and broaden work in the defense sector.

Purdue University photo/Charles Jischke